Investing in an Inflationary / Deflationary Regime

Transcript of Chair Powell’s Press Conference

November 2, 2022

NICK TIMIRAOS. Nick Timiraos of the Wall Street Journal. Chair Powell, core PCE inflation on a 3 or 6-month annualized basis and on a 12-month basis has been running in the high 4’s, close to 5 percent. Is there any reason to think you won’t have to raise rates at least above that level to be confident that you are imparting enough restraint to bring inflation down?

CHAIR POWELL. So, this is the question of [inaudible] does the policy rate need to get above the inflation rate? And I would say, there is a range of views on it. That’s the classic Taylor principle view. But I would think you’d look more at a forward, a forward-looking measure of inflation to look at that. But, I think the answer is, we’ll want to get the policy rate to a level where it is, where the real interest rate is positive. We will want to do that. I do not think of it as the single and only touchstone though. I think you put some weight on that, you also put some weight on rates across the curve. Very few people borrow at the short end, at the federal funds rate for example, so households and businesses, if they’re very meaningfully positive interest rates all across the curve for them, credit spreads are larger so borrowing rates are significantly higher and I think financial conditions have tightened quite a bit. So, I would look at that as an important feature. I’d put some weight on it but I wouldn’t say it’s something that is the single dominant thing to look at

Inflation Expectations

Inflation expectations are used by central banks as one of the inputs for assessing the inflation outlook and the associated risks. Inflation expectations affect how workers and firms set prices and wages; determine the level of real interest rates; and, especially over longer horizons, provide an indication of the central banks’ inflation-targeting credibility (Moore 2016).

How are the expectations measured?

There are three main types of inflation expectations measures: market-implied, which are derived from observed prices of financial instruments with payoffs linked closely to future inflation outcomes such as TIPS and Inflation-Linked Swaps; surveys of professional forecasters’ expectations; and surveys of consumers’ expectations. These measures capture different types of expectations and are constructed differently.

The table below is a quick recap, although not exhaustive, of the most commonly used inflation expectations measures:

Are these measures reliable?

The forecasting ability of inflation expectations measures in advanced economies has been mixed. Consumer inflation expectations are the least accurate. Market-implied measures have been able to anticipate inflation accurately over the subsequent year, but their reliability is weak for longer time horizons. Personally, I think market-implied expectations are not very reliable because there are so many factors related to the micro-structure of TIPS and inflation-swaps market that distort the general picture (FED buying TIPS, Liquidity Premium, Supply-Demand Imbalanced, etc.). In general, I would conclude that professional forecasters’ inflation expectations have been the least biased and the most accurate at predicting future inflation.

Aruoba Term Structure of Inflation Expectations

The term structure of inflation expectations, as measured by the Federal Reserve of Philadelphia.

Source: Philadelphia FED

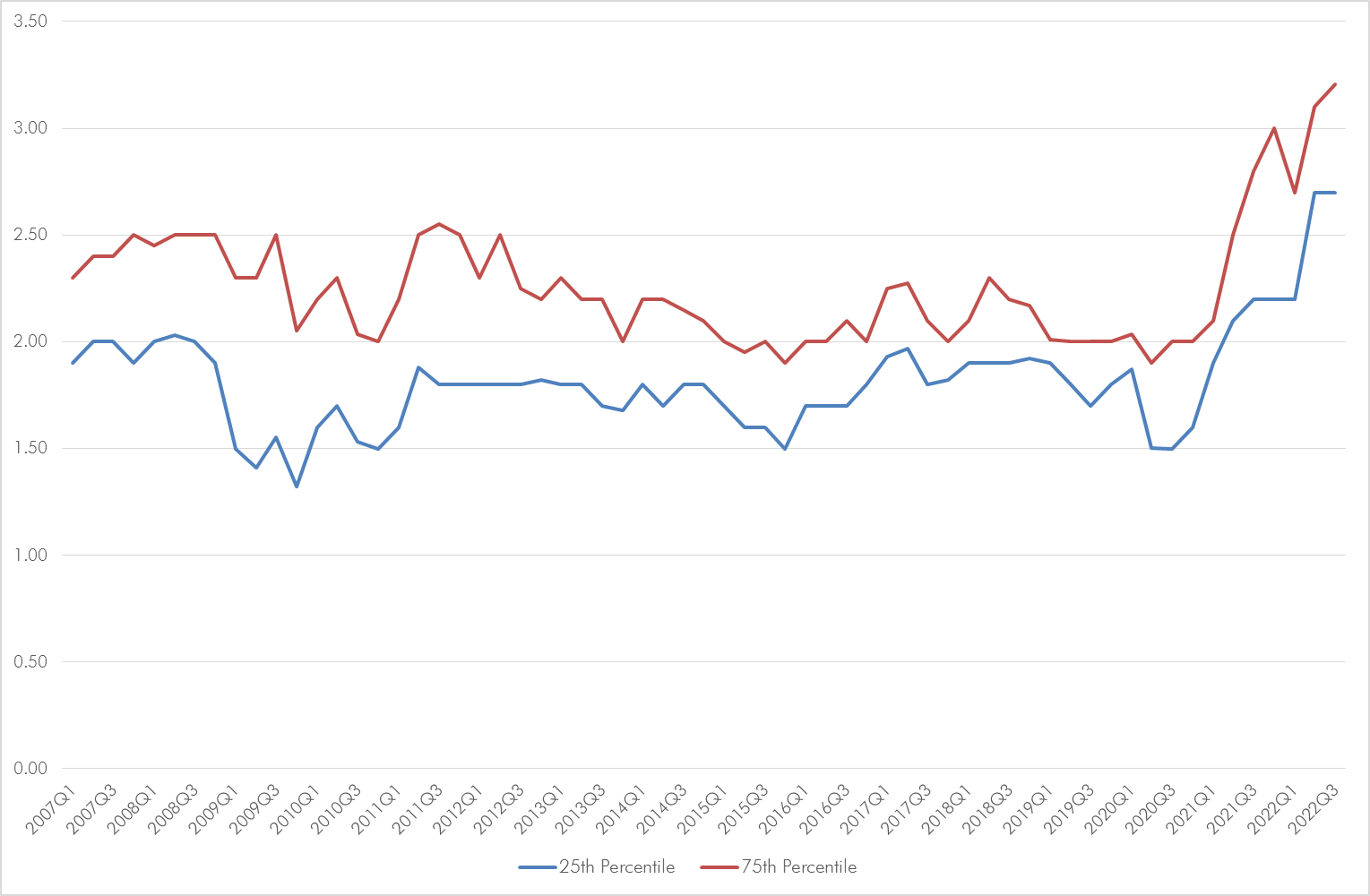

Inflation Expectations Dispersion

Source: Philadelphia FED

Bimodal Distribution – Inflation vs Deflation Regime

Expectations seem very optimistic to me. The scenario where the FED (and central banks in general) manages to bring inflation exactly on target is probably the least likely scenario. I see it much more realistic that either inflation remains sticky around 4-5% or central banks tighten too much and push the economy into a hard landing with inflation actually crashing below zero.

Inflation expectations are not a point, they are a distribution. It feels like a bi-modal distribution that combines these two main scenarios: high inflation or outright deflation.

The chart below – do not get fixated on the numbers – just wants to illustrate the idea.

Personally, I would give about ca. 65% probability to the inflationary scenario (historical evidence shows that it takes years for such high inflation to revert to target) and about 35% probability to the hard landing event, in line with what we published yesterday in the mid-term elections piece.

Portfolio Construction Blog Series

On the back of this hypothesis, where either inflation remains elevated and above target for a protracted period of time or inflation heads back down into deflationary territory, we will publish a series of blogs about “Investing in Inflationary Regimes” and “Investing in Deflationary Regimes”. We will take a closer look at portfolio construction in these two opposite worlds.

Financial Conditions

“…I think financial conditions have tightened quite a bit” (J.T.Powell)

That was the other key piece of information contained in the last Chair Powell’s press conference.

Source: ASR, US FRB, S&P Global and Datastream

Data seems to confirm this point. In fact, one key read from the Q4 senior loan officers survey is for credit. The tightening of lending standards today implies that by the middle of next year corporate credit default rates in the High Yield space could be 8%, not the ca. 4.8% implied in the 1Y CDS (I assumed a liquidity premium of 40bps and a recovery value of 40%). See the chart above.

Market Conclusions

US inflation came today at 7.7% below market expectations (estimates at 7.9%). I don’t think it is a huge game changer, but it is certainly encouraging and most likely markets will like that!

CPI current data is very important as the FED needs to see inflation coming down decisively. A series of down monthly readings would be good evidence that we are heading back on track. But, we are not there, yet! Powell also pointed out that they are looking at the FED policy rate in the context of inflation expectations.

Source: Bloomberg

In that light, financial conditions are already restrictive and real rates (when measured against expectations) are already in positive territory. And that’s what the FED wanted to achieve. Therefore so far: the mission is half accomplished.

My base case (65% probability) is that the FED pauses sooner than the market anticipates. The probability that the FED overtightens is in my view around 35%. In that case, brace for a very bumpy Credit Road. Creating a balance sheet recession to solve the inflationary issue, cannot be the chosen path! Hopefully, JT Powell sees the clear flashing red lights!

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity whatsoever with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics.

Leave a Reply