Getting Quiet!

Major market events 19th – 23rd December 2022

Highlights for the week

Mon: NAHB Home Builders’ Index, Germany IFO.

Tue: US Housing data, EZ Consumer Confidence December.

Wed: Germany GfK Consumer Confidence, US Current Account, US Housing Starts, Canada CPI, Crude Inventories.

Thur: Chicago FED National Activity. Mexico Core Inflation.

Fri: Japan CPI, Taiwan Industrial Output, US Personal Spending.

Watch: A slew of reports will gauge the health of the Housing Market, while US personal spending will also be in focus. The market will also pay close attention to Nike’s results after the bell on Tuesday. Other key earnings include General Mills, Carmax, Micron, and FedEx.

Before taking a glimpse into next week’s events, it may be helpful to review last week’s major events as markets are still licking their wounds after a very bumpy week.

Central Banks’ Shockwaves

The FED. The comparison between last week’s dot plot and the September dot plot is probably the best summary. Images are often worth more than a 1,000 words!

Source: ForexLive

First of all, the median rate projection at the end of the CY 2023 moves up to 5.1% from 4.6%. Second, the FED revises marginally projections for 2024 and 2025. What I find striking is the shape of the dot plot. Let’s pay close attention to it. There can be several interpretations of why the FED itself expects to be engaged in rate cuts somewhere in time. It could mean they successfully manage to bring inflation gradually back on target. I like that. But probably that ain’t the truth. The truth is that they probably expect their policy action to break down the economy. They will stand ready then to cut rates and fix the damage. After all, that would be the environment where they feel most comfortable! Sorry for those they will be included in the unemployment reports. But, those are – in the FED’s view – expendable pawns. Sorry!

The ECB. Revenge is a dish best served cold! Chapter II: The Reverse Pivot!

Come on, they did it. The ECB pivoted. Yes, but in the wrong direction: they became more hawkish! The terminal rate is now around 3.2%. Additionally, they announced that they will start reducing the 5 trillion euros worth of bond holdings’ balance sheet from March next year. The initial pace will be 15bn per month until June, and the subsequent pace will be determined over time. With that signaling that QT will gain speed over time! Bottom line: rate hikes + QT.

These are major steps!

What I found also significant is the following. First of all the phrases “interest rates will still have to rise significantly at a steady pace” and “keeping interest rates at restrictive levels will over time reduce inflation”. Second, the other important piece of the puzzle is that the ECB raised its core inflation forecast for 2023 to 4.2%. This is very relevant because – if we take the ECB seriously – this would imply that to be restrictive the ECB would need to bring its policy rate above the core inflation projection of 4.2%. It clearly looks like the ECB is trying to engineer the same type of hawkish shift that Powell engineered at Jackon Hole last summer. My main concern here is the timing. And timing is everything, after all! When all the other central banks are trying to slow down the pace of tightening the ECB is accelerating its pace. This seems to me ill-conceived, and doomed to fail! History will tell but let’s brace for a very bumpy road!

Earnings Calendar Highlights

Once again markets were on a down note last week; it seems that the tailwinds generated by the supposedly dovish attitude of the Central Banks which started from Governor Powell’s speech at Brookings did not quite last. Despite a positive CPI coming at 0.1% vs 0.3% forecasted which should have supported a positive stance for equities, both the stock and the bond markets tanked on what is a more hawkish stance by the Fed and the ECB. Indeed the European Bonds was even more sensitive than their US counterparts to a possible raising of the peak rates to a level beyond current expectations and as much as > 4%. In the US, the Fed seems to focus more on employment, which is a lagging indicator, rather than on inflation, which has slowed in recent months, with the consequence that it might trigger an unnecessary hard recession. Value did better than growth once again – a classic trend when the markets are in a downward spiral – but this time Europe took a beating too, certainly triggered by the hawkish forecasts of the ECB.

Source: Goldman Sachs Global Investment Research

The Federal Reserve reduced the size of its hikes, increasing the Fed Funds rate by 50bps as expected. Still, it issued a comment that the terminal rate might be higher than the markets’ own expectations. US bond markets are unfazed; the chart above shows that consensus expects a terminal rate in May 2023 which is lower than the one forecasted by Goldman Sachs. That should have been beneficial for the markets, which instead worried about the possibility that the US Central Bank might overtighten driven by an extremely hawkish view on inflation.

Source: BofA Global Fund Manager Survey

With bonds now offering good returns and with the peak in US Rates certainly nearing, no matter what the Fed says, it is of very little surprise that asset allocation is heavily tilted toward bonds, which I think have the best chance of recovery after what has been a dismal year for investments (apart from commodities). The chart below displays the result of a bruising year for both stocks and bonds – I wrote that it looked like 2008 but this chart makes it look much worse. The obvious question – which of the two is going to improve first? I think it will be bonds rather than stocks! Even considering the most bullish scenario, that of a 5.5% growth in EPS (as estimated by Factset) over the 2022 consensus of $221 per share to $233.15 per share and a rather improbable (under current circumstances) expansion of the multiple to 18x we would get to a target for the S&P500 of roughly 4200, with would mean a 9% upside from current levels. However, the more bearish scenario is much worse: EPS would see a 15% contraction to $ 195 (as posited by Morgan Stanley), and the multiple might well contract to 16x. The result? 3120, or 19% downside. Not exactly the risk-reward you’d want to see.

Source: Bloomberg, Lombard Odier

At the same time, the below chart shows that there is still a considerable difference between the GDP forecasts of the Atlanta Fed (top-down) and those of the blue-chip companies. In a way, it is worrying because the Fed is relying on the former instead of on the latter. But sooner or later one has to catch up with the other. Something’s got to give.

Source: Blue Chip Economic Indicators and Blue Chip Financial Forecasts

Source: S&P Global

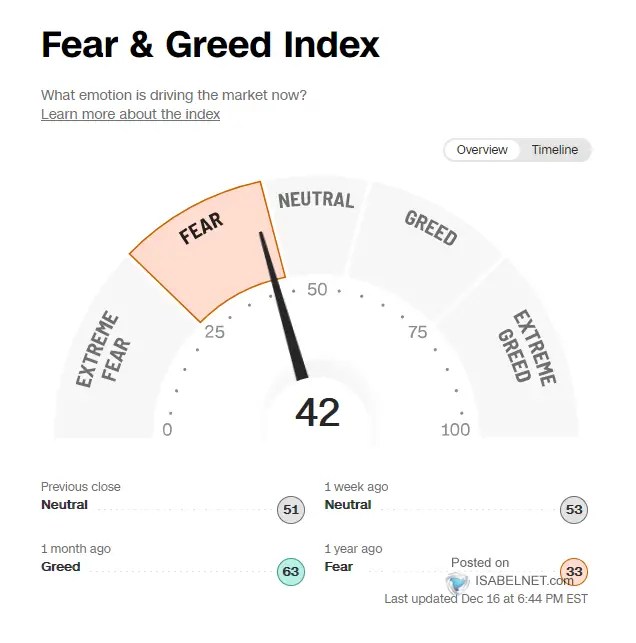

It should come as no surprise that risk aversion is mounting and in fact, after Governor Powell’s speech at Brookings, the equity market has gone South ever since. Until we get more clarity on the Fed’s intentions and the real impact of its tightening on the economy I think the market will trade sideways at best. Even the famous ‘January Effect’ might be much more muted this time given all the uncertainties we have to deal with. This is corroborated by the Fear and Greed indicator below – the tables have turned very quickly since a couple of weeks ago!

Source: ISABELNET.com

Very few strategies worked this year, on the long side the main ones being long USD and long commodities. On the short side, well there are plenty of choices indeed. Amid the few bright spots of 2022, there is Merger Arbitrage – although I have to point out that both M&A and Capital Markets have significantly slowed down over time.

Source: Bloomberg

Finally, there is another bright spot amid all this doom and gloom. While even Main Street did see a contraction, it significantly outperformed Wall Street last year. It is hoped that Main Street may help cushion the fall from Wall Street and soften the impact on the economy, now that the Fed seems bent on triggering a recession no matter what in order to fight what it calls persistent and not transitory inflation.

Source: BofA Global Investment Strategy, Haver

For 4Q22 the forecasted EPS decline for the S&P500 on aggregate is -2.8% – revised downwards from -2.5% just a week ago. If correct, it will mark the first time there has been a year-on-year decline since 3Q20, when such a decline was -5.7%. Despite the concern about a possible recession next year, analysts still forecast a positive growth in earnings for the overall market in CY 2023 of 5.5% year on year. (Recall: Goldman is at 0% growth; Morgan Stanley is 15% below consensus in 2023 for a -12% growth over 2022).

Source: Factset

Very few sectors are holding up estimates relative to just 3 months ago. The only sectors not to have their estimates cut further are Financials and Utilities; all the others are facing cuts. Regarding CY2022, excluding Energy, the index would report a decline in earnings of -1.8% as opposed to a climb of 5.1%. This is definitely going to change next year, and I still would stick with Utilities – rather than Energy – despite the top in rates not being reached until May 2023.

Source: Factset

The same applies – once more – to revenue growth, with every sector having had its growth estimates cut relative to 3 months ago. As you can imagine, the ones which suffered the most limited declines were Health Care and Consumer Staples. Information Technology has almost got in line with the average growth, and I guess more clarity will be needed on rates and economic growth to see a chance, later next year, to see their revenue growth go up again.

Source: Factset

In this chart, you can see how EPS progressed over the year. They are mostly stable in 2022, with 2023 taking the brunt of the cuts. Most of the decline started in June when the impact of the hiking cycle of the Central Banks became evident and continued at a steady pace ever since.

Source: Factset

This is the detail for 4Q22. I’d say that the market is more concerned about rates and recession than is about earnings at this point. Presently, valuation is slightly above the 10-Year average, with a P/E Ratio of 17.3 vs 17.1, while still below the 5-Year average of 18.5 as shown in the chart below.

Source: Factset

The earnings season is now looking at 4Q22. Highlights this week include Nike (Tuesday, After Close), FedEx (Tuesday, After Close), and Micron (Wednesday, After Close).

Source: Earnings Whispers

Market Considerations

A much more eventful week for Central Banks, even with a CPI that was better than expected. Fears that the top in rates might be higher than expected forced yet another re-price of risk and sent the markets down. European bonds were hit particularly hard as the current environment makes things indeed more difficult for significantly indebted peripheral countries (Italy, Greece). At the moment I am much more sanguine on bonds than I am on equities, largely because the top in rates is within reach and I cannot see yet the bottom in equities. Do take all opportunities to lighten up in equities and reinvest in bonds at attractive (approx. 4%) yields. It might well result in a few turbulent months – as rates expectations in Europe are, at 3.4%, below the ECB’s estimates of 4% – but I believe this will pay off in the end. It’s just a question of timing; always fraction your investments and scatter your entry points and you should do fine.

Additionally, you may remember that a few weeks ago, we recommended entering the relative value trade long US 2Y rates vs Short German 2Y rates. The trade has probably a bit more to run, but coming into year-end, it is probably sensible to take the chips off the table and take profit on the position.

Over and Out.

InflectionPoint

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics

Leave a Reply