Central Banks’ Time!

Major market events 12th – 16th December 2022

Highlights for the week

Mon: UK GDP Estimate, China M2/New Loans (NOV)

Tue: OPEC, BOE FSR (Let’s see what they say of the Pension Funds’ debacle), German CPI, US CPI, UK unemployment, EZ ZEW, Japan Tankan (Q4).

Wed: FOMC Policy, UK CPI, US & Japan Import/Export prices.

Thur: ECB, BOE, SNB, Norges Bank & Banxico policy decisions. China & US Retail Sales. Australian Employment.

Fri: EZ,UK & US Flash PMIs. Central Bank of Russia.

Watch Next week we will have a pile of economic data under the Xmas tree, including CPI in the US, Germany & the UK, and global flash PMIs. It is unlikely though that the data is going to move the dial too much for the major central banks. Nonetheless, the market will pay attention to the incoming inflation data for confirmation that disinflationary forces continue and global inflation pressures have finally turned the corner.

Before digging a bit deeper into Equity valuations let’s take a closer look at what markets expect from the next central banks’ meetings.

Central Banks’ Time

THE FED

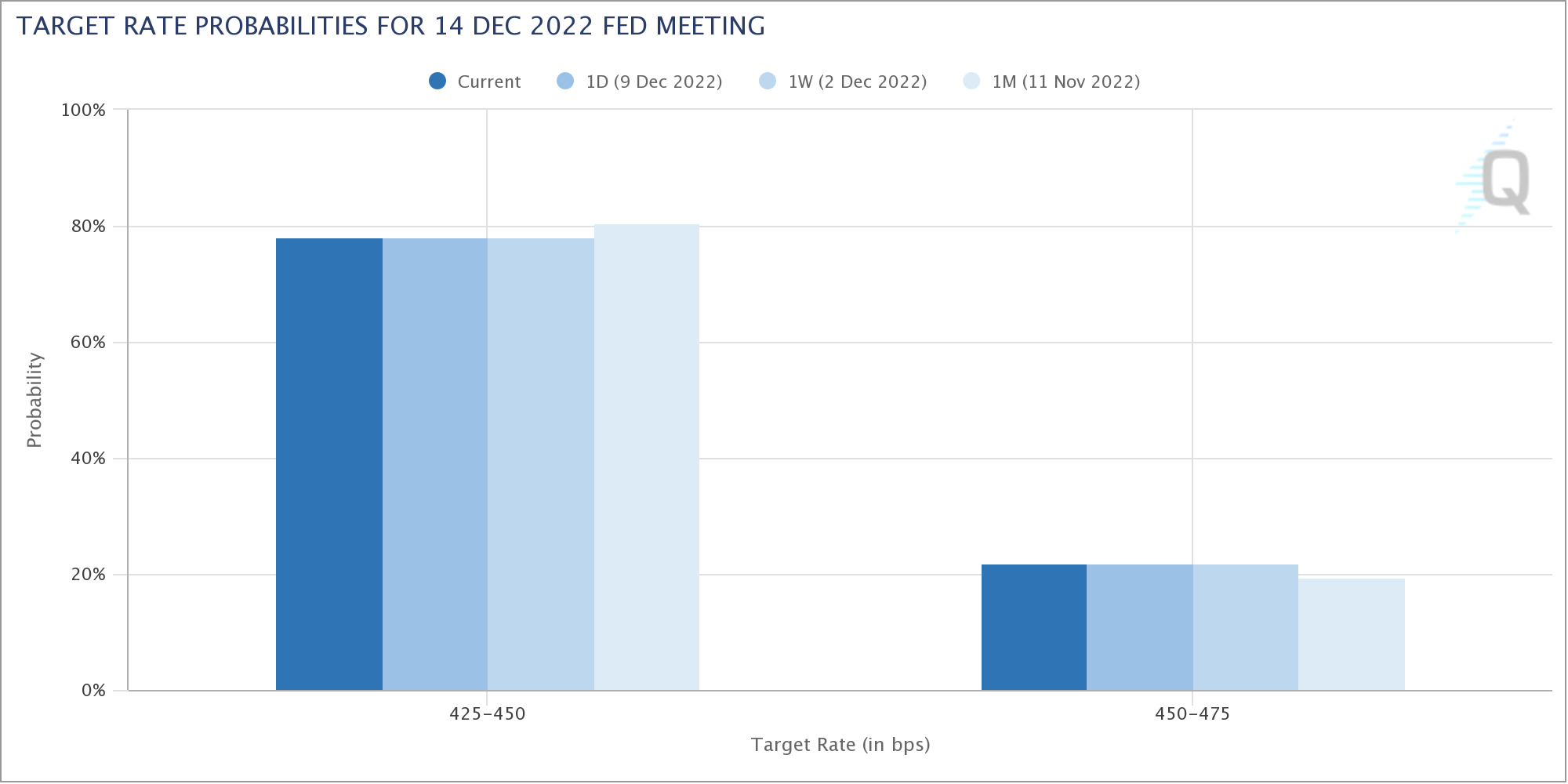

Markets are firmly expecting the Federal Reserve to opt for a 50bp hike at the 14 December Federal Open Market Committee (FOMC) meeting after already implementing 375bp of rate hikes, including consecutive 75bp moves at the previous four meetings. The following chart displays the market-implied probabilities for the next meeting.

Source: CME FED Watch Tool

As we can see, almost 80% probability is given to the event that the FOMC will go ahead with a 50bps pivoting from the latest 75bps moves. We can also spot, from the historical plots, that these probabilities have been rather firm over time as pricing did not swing much over the past few weeks.

Source: CME FED Watch Tool

The other chart – the one above – plots instead the market-implied FED rate for the end of next year. The distribution of the expectations peaks at around 475bps, which is very close to the policy rate expected for next week. According to the market, the FED is pretty much done!

Let me also add a scenario analysis from ING Macro, which I think is a valid compass to trade around the FED press conference. Here we go!

Source: ING Think

THE ECB

After the 75bps increase at the October meeting, a downshift to a 50bps increment is expected by a large majority of economists surveyed by Reuters. But I would not underestimate the risk of a 75bp rate hike at next week’s ECB meeting. Next to the rate hike, the ECB is likely to set out some general principles of how it plans to reduce its bond holdings. We expect the ECB to eventually reduce its reinvestments of bond purchases but to refrain from outright selling of bonds. If that happens overall, good news from the ECB. QT is where things could get messy for the Eurozone, much more than with rate hikes. Welcome 75bps if there is good news on the bond holdings!

THE SNB

After a 50bp increase in June and a 75bp increase in September, the Swiss policy rate returned to positive territory at 0.5%. At its December meeting, the SNB is expected to acknowledge that Swiss inflation has probably passed its peak and that the deceleration observed since the summer is a good thing. We expect the SNB to make a final 50bp hike at its March 2023 meeting, bringing the rate to 1.5% and leaving it there for an extended period.

THE BOE

Policymakers on the MPC are expected to also step down to a 50bps rate hike pace compared to the 75bps implemented in December. My best guess is that the decision will not be unanimous as there will be some dissenters urging for a larger 75bps. But that will be for the annals of the history books.

THE Bottom Line

Central banks are holding their horses. That’s what matters and any hawkish rhetoric that is going to follow will fall on deaf ears, as markets will be focused on pricing the next inflation data points and recession probabilities!

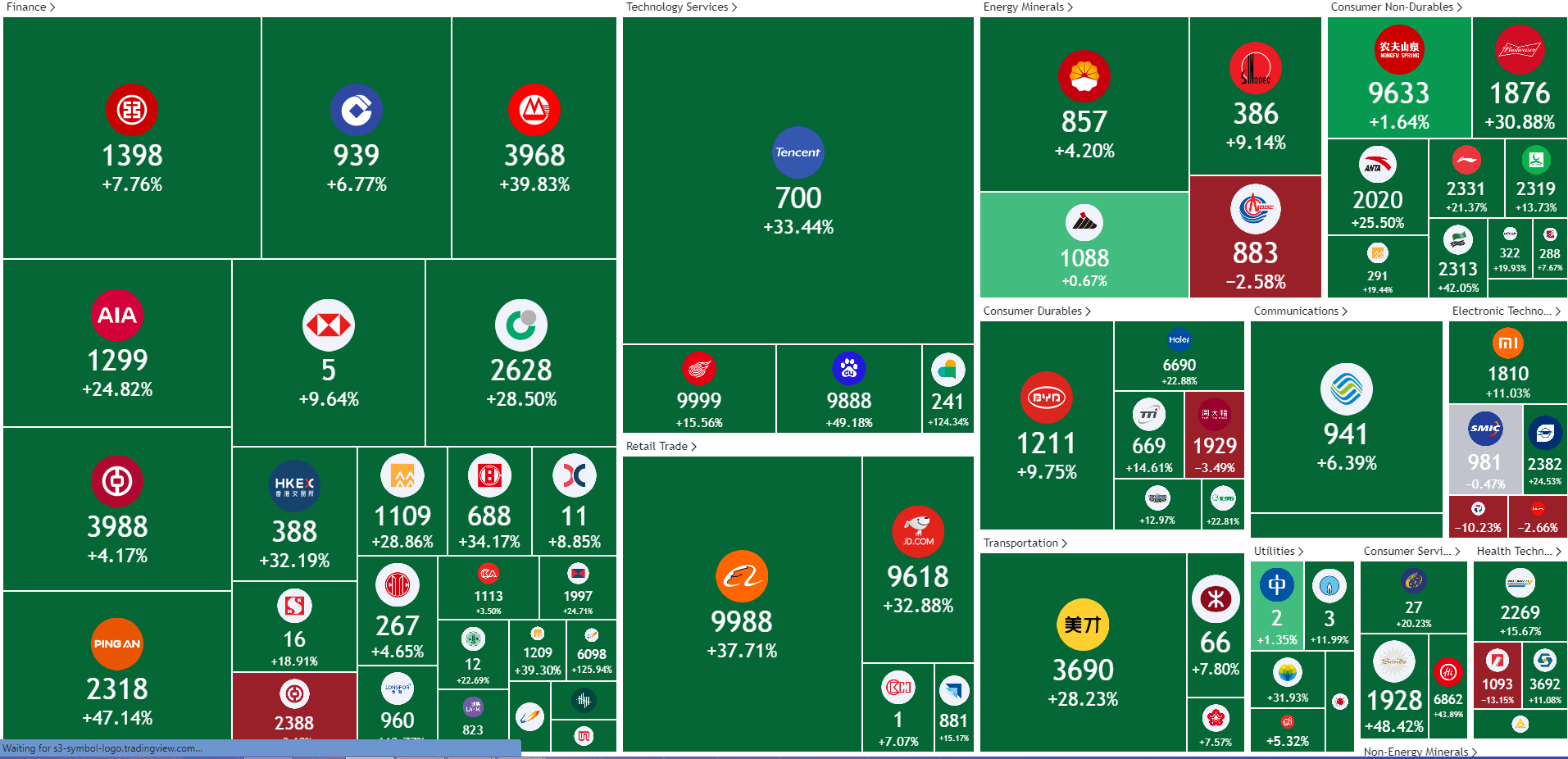

Before we have Giorgio digging deeper into equity analysis, let me quickly present a couple of heatmaps, which I think are a good visual representation of the market pricing in terms of FED pivot and China Reopen!

FED Pivot Heatmap (last 1M)!

Source TradingView

China Reopen Heatmap (Last 1M)!

Source TradingView

Earnings Calendar Highlights

Markets were on a down note last week, with the notable exception of Japan. The staggering performance of the previous week – driven by a perceived pivot by Fed Governor Jay Powell in his comments at Brookings – did not quite last. Yields went up again, and the narrative during the week seemed to be a question of whether the US Central Bank has actually dominated inflation and how far rates will have to raise to achieve that objective. Meanwhile, the ever-present specter of global recession has resurfaced, despite China’s loosening of its zero Covid policy and the slow reopening of some major cities. At the same time, Japan – the only major economy which does not have to deal with a major tightening cycle – continued on its slow but steady path. Value outperformed growth and Europe outperformed (lost less than) the US once again. This really looks like the ‘same old and sad story of 2022.

More to come? The chart below displays the returns of the S&P500 once the Federal Reserve has started hiking rates. The results are far from pretty, although over time markets have continued to climb. The consideration I would like to add is that the last Fed Pivot was due to a global pandemic, while the previous one to a global financial crisis. This one seems more similar to a classic inflation-fighting textbook, even though a major component of this has been due to the ongoing war in Ukraine, and as a result, no one knows when it will stop.

Source: Real Investment Advice

I would like to underscore that this is an ongoing debate – certainly, the Fed stopping its hiking cycle will be much more beneficial for the economy, especially on a perceived basis, but how much damage has already been done? Meanwhile, in a recent survey, over 40% of investors expect the top of the Fed Funds rate to be 5% (I voted 5.5% which was backed by 36% of respondents). According to the chart below, this seems to be a consensus view even after a week that was not kind neither with the equity markets nor with rates and yields. Most of the investment banks seem to forecast a Fed Funds Terminal rate at 5% or below! 5% Bank of America, Credit Suisse, Goldman Sachs, JP Morgan, Stifel, UBS 4.75% BMO, Deutsche Bank, Morgan Stanley, and Wells Fargo.

Source: The Daily Shot

Considering that this came in a week where the much-awaited November PPI did not give me any joy at 0.3% vs 0.2% forecasted and with the previous months’ also revised upwards to 0.3%, it was not too bad. Amid this backdrop, I have to note an article by Nick Timiraos, the WSJ’s chief economic correspondent, which states that wage inflation could bring the Fed to hike the benchmark rate beyond the 5% the market is currently expecting. Holding my breath for the November CPI on Tuesday the 13th and hope we might get a nice Christmas present after a dismal year. The Fed is likely to raise Fed Funds rates by 50bp on Wednesday 14th and much attention will be given to their outlook for 2023 and to how close are we in terms of peak rates. In the same recent survey 57% of respondents, including me, thought that the Fed was ‘unlikely’ to cut rates in 2023 – and hence it’s all down to the economy. But the market doesn’t seem to think this way, according to the chart below. I’d like to remember that the Fed will continue to be data-dependent and will continue to adjust its policy in synch. Governor Powell said that the economy was strong and able to withstand higher rates, but it much depends on which angle you gauge this. From the technology companies’ own standpoint, it is certainly not.

Source: Bloomberg

Good old Europe to the rescue? Well, rates are raising here as well, even though inflation has eventually started to slow for the first time in the last year and a half. The ECB’s Governing Member Constantinos Herodotou said that while interest rates have to go up, they are “very near” their neutral level. The chart below highlights Europe’s value characteristics and signals that its valuation is very cheap versus the US, to a measure not seen even during the financial crisis of 2008. The gap will have to close, and this has led some pundits to posture that Europe’s stock market might be the one to bet on next year, due to its more defensive characteristics. I still prefer the US due to the dynamism of its economy, but I note that this year the trade has not worked and it certainly won’t next year if the US economy is going into a recession.

Source: The Daily Shot

We will now have a look at the US Economy and at the chance of it going into a recession in 2023. Goldman Sachs is one of the major houses which posits that yes, there will be economic growth next year. The chart below shows exactly where Goldman stands relative to consensus. I note that even the consensus is not too dramatic by forecasting negative growth in 1Q and 2Q 23; future data will tell us how much the Fed’s restrictive policy hit the real economy.

Source: Goldman Sachs

And going back to the SPX there are different valuation levels and different paths that we have to consider while establishing the likeliest path next year. Much will depend on the economy and on cuts to corporate earnings. That said, the path does not seem an easy one even in the best scenario, that of a soft landing, while owing to the Fed’s recent hiking cycle, Treasuries offer good value. I would take advantage of any rally in Equities to lighten up and reinvest in Treasuries, while going beyond the traditional 60/40 model, to 70/30 or even – for investors who are most risk-averse – to 80/20 while taking full advantage of minimum volatility trackers for the equity part.

Source: Goldman Sachs Global Investment Research

If the trough is 14x and there is a further compression on earnings this could get pretty ugly – with the impact so severe for the SPX to reach 2800 – watch out!

Source: Goldman Sachs Global Investment Research

Finally, please find an updated chart of EPS Estimates for the S&P500 for 2023. I note that even Morgan Stanley, a notorious bear, has increased its estimates for 2023 from $ 190 a few weeks ago to $ 195. Do even bears have a heart? Probably not – they just rolled over the 15% discount over the latest forecast, thus yielding the raise. We shall see – stay tuned,

Source: Refinitiv, S&P, MS & Co, Research

For 4Q22 the forecasted EPS decline for the S&P500 on aggregate is -2.5%. If correct, it will mark the first time there is a year-on-year decline since 3Q20, when the such decline was -5.7%. Despite the concern about a possible recession next year, analysts still forecast a positive growth in earnings for the overall market in CY 2023 of 5.5% year on year. (Recall: Goldman is at 0% growth; Morgan Stanley is 15% below consensus in 2023 for a -12% growth over 2022).

Source: Factset

On a sector basis, you can see that Energy is poised to have the biggest decline and that coupled with the threat of a recession will dampen their prospects for an increase in the price of oil and commodities, despite the very harsh winter we are facing. Information Technology isn’t doing particularly well but it’s also not too far off the average. I would look in corporate reports for signs of stabilization in demand, especially in the global advertising market. Financials will benefit from the global (ex-Japan) hike in rates. Utilities are probably a better bet than Energy at this point.

Source: Factset

A similar picture in terms of revenue growth, which – if confirmed – wouldn’t be too shabby at 3.3%. Again Energy led the declines, balanced by Financials on the upside. Here Information Technology does a little bit better than the average, which would be a very positive development for the sector.

Source: Factset

Surprised to see such a positive and constructive picture of Net Margins despite the meaningful pressures hitting the economy from all sides. I’d say profit margins have held up very well compared to the record year that was 2021, with a tiny element of growth built in 2023.

Source: Factset

On a sector level. treating Real Estate as an outlier, profit margins are led by Information Technology, with forecasts pretty much in line or with a tiny increase for next year. Most sectors (Financials, Utilities, Communication Services, Industrials, Consumer Discretionary, and Consumer Staples) actually see their margins flat to up for next year, probably highlighting once more that the real problem is on the demand side.

At the same time, valuation is right in line with the 10-Year average, with a P/E Ratio of 17.1 vs 17.1, while still below the 5-Year average of 18.5 as shown in the chart below.

Source: Factset

The earnings season is now looking at 4Q22. Highlights this week include Oracle (Monday, After Close), Coupa (Monday, After Close), Lennar (Wednesday, After Close), Jabil (Thursday, Before Open), Adobe (Thursday, After Close), and Accenture (Friday, Before Open).

Source: Earnings Whispers

Market Considerations

There is a risk of a real contraction in Equity Markets (with the US and Tech more vulnerable than Europe and Japan), with a double whammy hit on the multiple and on earnings if the much-feared recession does indeed materialize. I’m starting to think that several themes (Fed, China Reopening) are being priced in already. The Recession might be priced in for bonds, due to the appearance of inverted curves, but probably not for Equities. The not-so-positive PPI was digested fairly well by the market but at the end of what was a tough week in which the themes of the previous one seemed no longer valid. The CPI near term for Equities is made or break so fingers crossed; I guess that the market would want to get comfortable with a 5% in Fed Funds and that’s it before looking at the world and at the future out there (2023). Much as this is a difficult consideration to make at the end of a year which brought very few smiles and a lot of angst, we certainly prefer bonds – even long-dated ones – over equities and would not be afraid to switch around the end of the year. Given the stormy seas out there, we think it’s best to repair for a while in a safe harbor before venturing out there again – that is particularly true for Nasdaq, Beta, and Risky Assets.

Disclaimer

All views expressed on this site are my own and do not represent the opinions of any entity with which I have been, am now, or will be affiliated. I assume no responsibility for any errors or omissions in the content of this site and there is no guarantee for completeness or accuracy. The content is food for thought and it is not meant to be a solicitation to trade or invest. Readers should perform their investment analysis and research and/or seek the advice of a licensed professional with direct knowledge of the reader’s specific risk profile characteristics

Leave a Reply