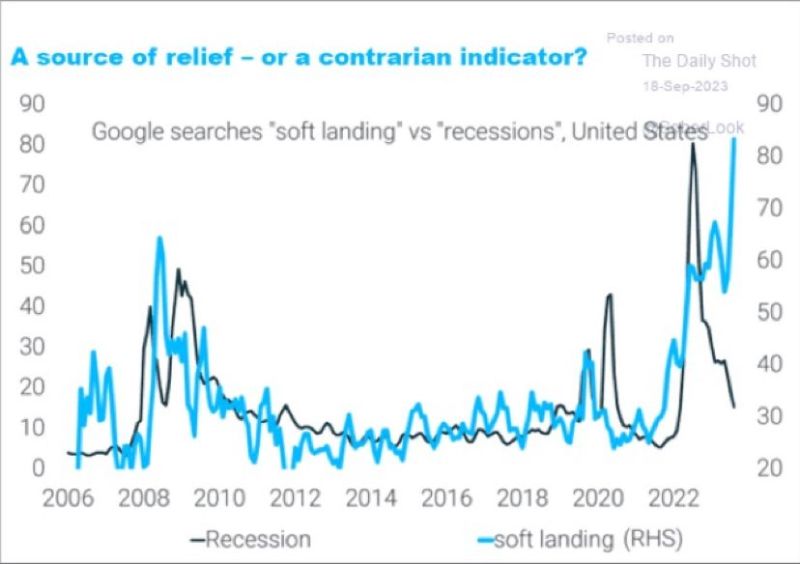

U.S. Market Sentiment

The fluctuation in market sentiment and narrative has been remarkable in recent months, as indicated by the stark variations in Google searches for “soft landing” versus “recessions.” For traders and investors, this dynamic could potentially serve as a compelling contrarian signal, especially in a market environment marked by subdued and compressed volatility (VIX). #volatility #google #marketsentiment #trading chart by #TheDailyShot, comment #InflectionPoint by Giorgio Vintani & Tom Baldacci!

Against this backdrop, volatility seems to be compressed across several asset classes, albeit with the notable exception of rates volatility (MOVE Index)

Cboe Oil ETF VIX @LizAnnSonders

GVZ Gold VIX @graddhybpc

VIX Futures @DougMoglia falling in tandem with short-term rolling volatility!

The combination of a complacent narrative and exceptionally low cross-asset volatility (except in rates), it does create the conditions for what could be described as an explosive mix – maybe a precursor of a turbulent journey ahead! Fasten your seatbelt!

http://www.InflectionPoint.blog

If you like our research and you wish to contribute to the funding of our research, please click below!

Leave a Reply