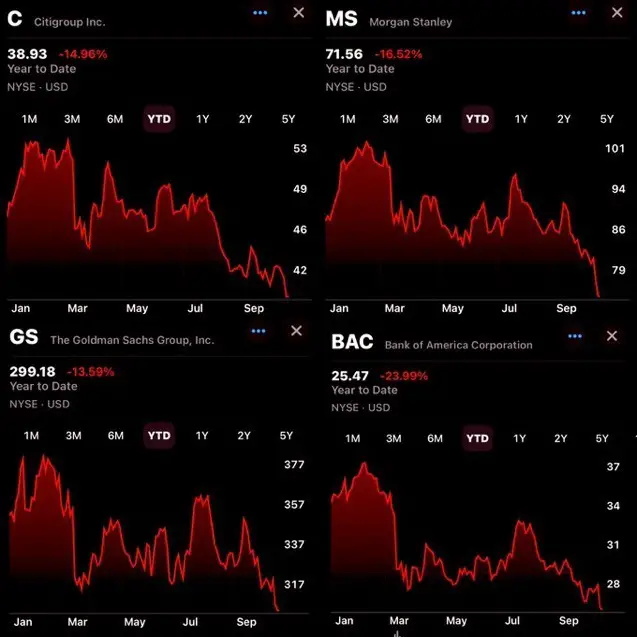

In a stunning market development, the leading financial giants on Wall Street are grappling with a steep decline, their stocks plunging to levels not witnessed since the haunting echoes of the March Banking Crisis. Year-to-date losses have sent shockwaves through the investment landscape, with drops ranging from 15% to a staggering 24%, igniting apprehension among investors and casting a shadow over the overall market sentiment.

This unsettling trend has raised alarming questions, hinting at the possibility that the crisis might be transcending individual institutions and taking on a systemic character. Simultaneously, it has become increasingly apparent that the traditional modus operandi of the banking sector is facing intense pressure, as disruptive technological advancements erode the once unassailable moats these financial titans once enjoyed. This onslaught of new technology has catalyzed a surge in competition from multiple fronts, intensifying the challenges faced by these banks in an already volatile market landscape.

#InflectionPoint – An unfolding narrative that demands close scrutiny, as the specter of a credit crunch looms ever larger on the horizon. This resounding market upheaval serves as a stark reminder that the tides of uncertainty may be steering us toward a credit crunch. Amidst the rapid erosion of the traditional banking landscape and the relentless surge of technological disruption, the vulnerability of the financial sector stands glaringly exposed, heralding a pivotal juncture that warrants vigilance.

Chart by The Coastal Journal

@giorgiovintani @tombaldacci

Leave a Reply