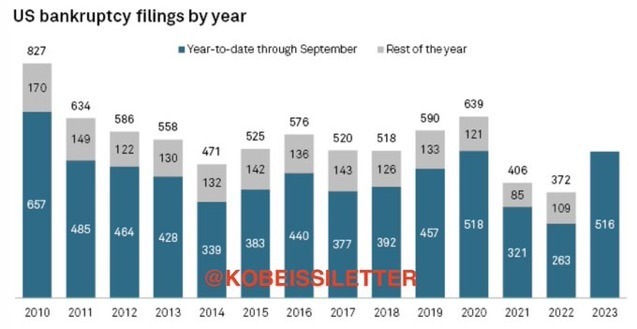

Newsworthy twist on the economic landscape: A significant split in credit dynamics. The tally for corporate bankruptcies in 2023 has surged to 516, marking a stark contrast from the figures of 2022, almost doubling the count, and up by approximately 39% from the complete total of the previous year. Remarkably, the 2023 bankruptcy rate mirrors the level witnessed during the global economic standstill of 2020, with the current year’s YTD count being the highest since 2010, all amidst expectations of persistently high interest rates throughout 2024.

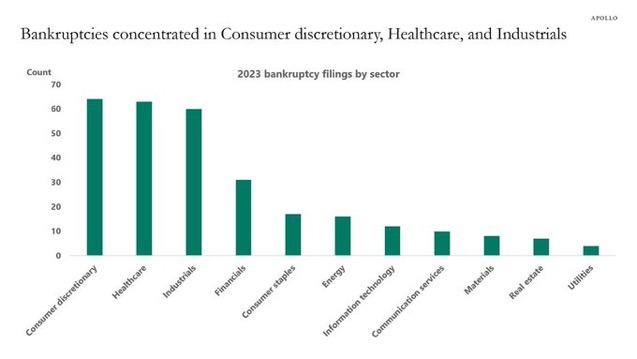

Notably, as emphasized by Torsten Slok, the companies most impacted by this surge are those in the Consumer Discretionary, Healthcare, and Industrials sectors, characterized by heavy debt burdens and subdued earnings.

Our thinking at #inflectionpoint:

While some sectors, having long relied on zero to negative rates, face a potentially severe credit crunch, other sectors – where reliance on debt has been very limited – may display resilience in the face of the credit shock, particularly those experiencing a slower but steady growth trajectory.

Charts by #kobeissiletter #torstenslok http://www.inflectionpoint.blog @giorgiovintani @tombaldacci

If you wish to contribute to our InflectionPoint research, please click on the PayPal button below ⬇️:

Leave a Reply