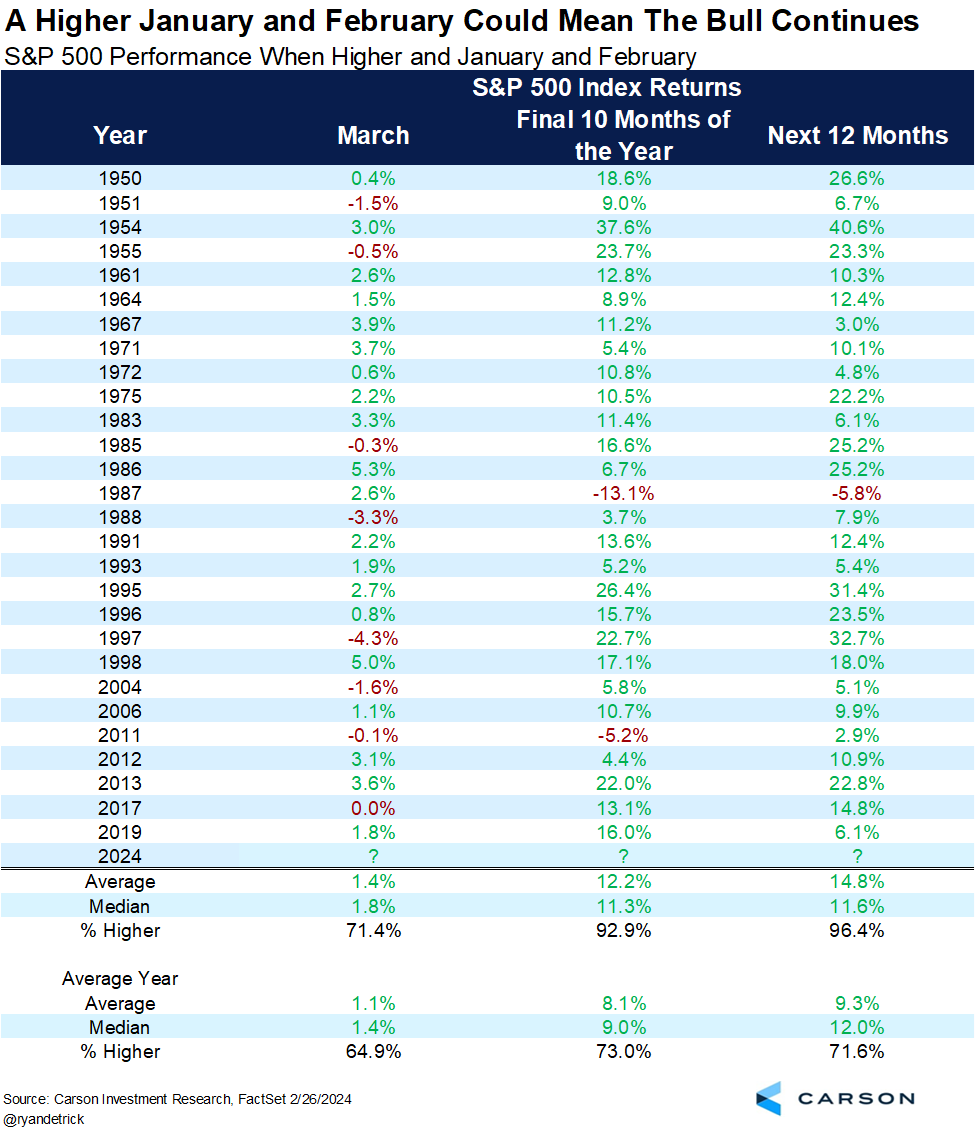

According to this chart from Carson Investment Research and Ryan Detrick, a higher January and February for the S&P 500 can predict future positive returns on a 12-month basis. Results for the remaining 10 Months of the year were higher 26 times out of 28, while results a year later were higher a staggering 27 times out of 28. Watch out for the upcoming Core Durable Orders and CB Consumer Confidence later today and for the US GDP tomorrow as a confirmation of this trend and to provide insights about what the Fed might do next (in March it will definitely stay the course and be on hold).

Continue to stay long equities, with the famous 3% weekly stop, even though it might make sense to take some profits here. But it looks like the bull market is here to stay, even though interest rates have been quite high lately. However, Tom has started switching some of his short-term debt into 30-year bonds and will switch the remaining part if interest rates continue to rise.

Source: Carson Investment Research, FactSet, Ryan Detrick

Leave a Reply